When Dick and Mac McDonald opened the first McDonald’s the idea was to bring fast, cheap food to busy people in the suburbs of Chicago.

The first hamburger back in 1948 cost just 15 cents.

That’s my son’s favorite burger (ketchup only, no onions or pickles) so I know it now costs $1.89 at my local McDonald’s.1 That means we’re looking at close to a 12x price increase in the past 77 years or so.

That sounds like a lot. It’s a big reason for this sentiment:

You know when I was a kid…

However, it’s not that egregious when you look at the inflation figures. That 12x price increase from 15 cents to nearly $2 equates to an annual inflation rate of 3.3%. The actual inflation rate over that period of time was 3.4% per year.

Over long periods of time, even small percentage gains can snowball. It’s one of the reasons your best friend when investing is a long time horizon. People have a hard time wrapping their heads around compounding over the long-run when it comes to prices, investments and incomes.

For instance, the median income for individuals in 1948 when a McDonald’s hamburger cost 15 cents was just $1,000 a year. Prices mean nothing without a denominator for some perspective.

Incomes change over time because of inflation, growth and progress.

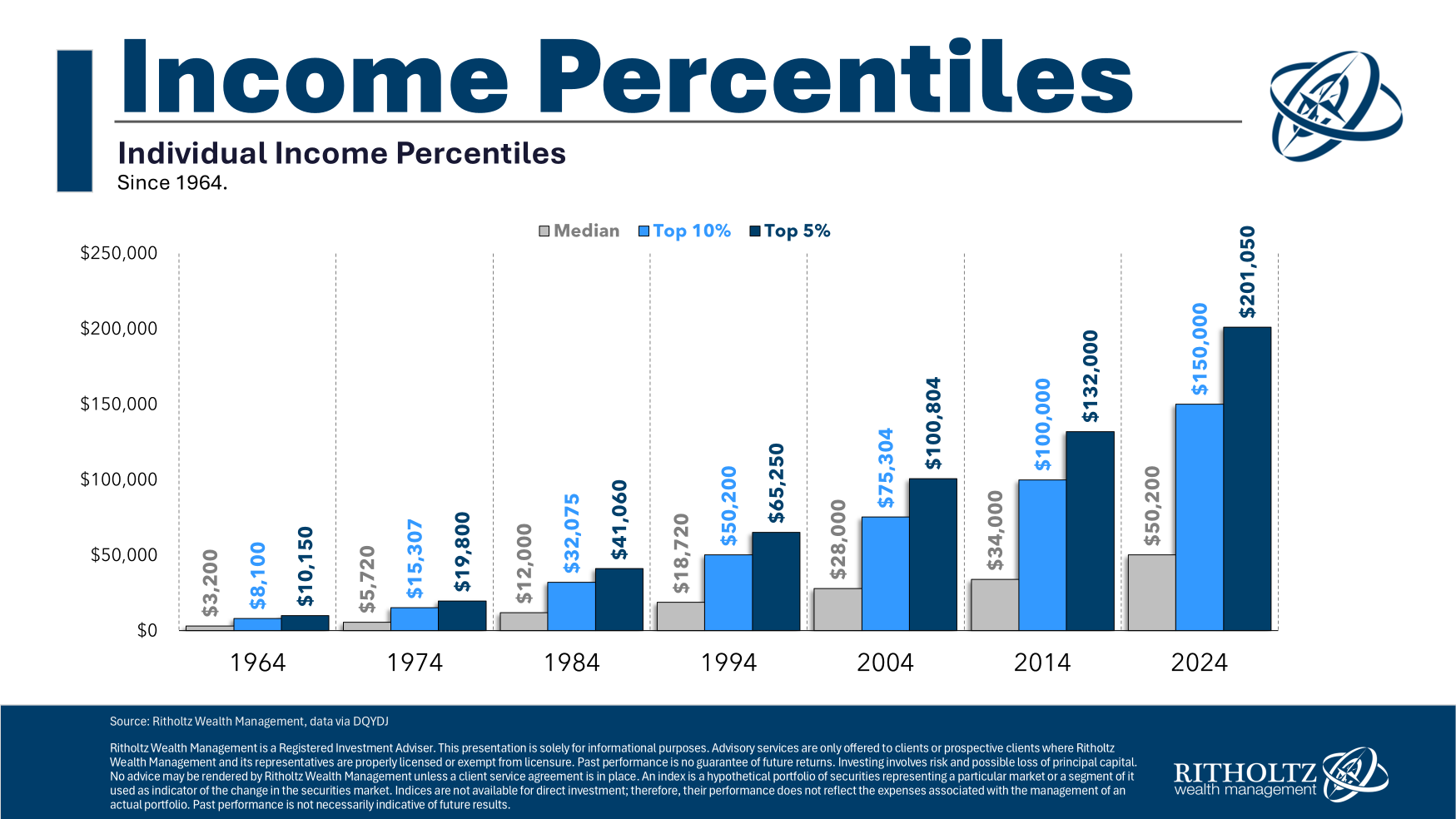

Look at the changes to individual income thresholds over time2 for the median, top 10% and top 5%:

It’s a steady march up and to the right. It’s also hard to believe how low the absolute income levels were back in the day.

Comparing current prices to past price levels can hurt your brain because you anchor to those previous numbers. This is especially true with housing costs this decade.

Lance Lambert recently interviewed a mortgage broker about how monthly payments have evolved in the Washington DC area for homebuyers at different levels given the immense rise in housing prices and mortgage rates:

My average first-time homebuyer now says $3,500 is comfortable, compared to the $2,000 to $2,500 range previously. Those looking for a family house now say $6,500 to $7,500; previously, $4,500 was the primary target. I’m also seeing more people more comfortable with $8,000 to $10,000 mortgage payments than ever. Honestly, for the first 20 years of my career, I don’t believe I ever had a mortgage payment offered over $10,000, and now I have a few of those each quarter.

These numbers sound insane when you compare them to monthly mortgage payments just a few short years ago when prices and rates were much lower. How can anyone afford these payments?!

They explain:

Keep in mind, in my region, incomes have exploded higher. I can’t seem to meet anyone who makes less than $130k per year. Those who used to be considered high-income ($250k to $300k) now make $450k. It’s just a different world now.

This is anecdotal. Washington DC is a relatively wealthy city. But the reason the economy continues to chug along despite much higher prices is become incomes are now much higher too.

In 2014, $100k put you in the top 10%. Now it takes $150k. The top 5% went from $132k to $201k. People are making way more money now.

Prices were far lower back in the 1960s because wages were lower.

Now, you could say all of the increases over time are because of inflation. And that would get you most of the way there. But there has been progress as well. These are the inflation-adjusted incomes for the top 10% in those same years:

- 1964 – $80,516

- 1974 – $104,856

- 1984 – $98,102

- 1994 – $105,901

- 2004 – $124,756

- 2014 – $130,736

What this tells us is wages for the top 10% have outpaced inflation over time. This is a good thing!

It’s true for median wages as well:

- 1964 – $31,809

- 1974 – $39,183

- 1984 – $36,702

- 1994 – $39,431

- 2004 – $46,388

- 2014 – $44,450

To be fair, inflation-adjusted wages have increased far more for the top 10% than the median wage earner. But it’s also true that few workers remain in the same income strata for their entire careers. People make more money over time. Some make less. Some see their incomes jump around from high to low and back again.

What you thought was a good income in the past might not get you as far in the future.

Good or bad, the goalposts are always moving.

Further Reading:

How Much Money is Enough?

1And being a personal finance person I obviously use the app to get another 20% off the bill every visit.

2DQYDJ is a really great website for these types of statistics. It’s worth a bookmark.