Well, not exactly digital but electrical. We saw the massive issue that created at Heathrow airport recently, but I’ve been personally affected by the same issue. Long story short, we have an electric gate at our property, and the electrics keep breaking down. Result? We are either locked in or locked out of our property. Lots of visits from electricians later, we’ve got it sorted, for now, but it made me nervous of the system and whether I can trust it works.

It’s a bit like a friend who compared airline trips to payments. As long as the aeroplane takes off and lands safely, you know you can trust it; if the planes crash every day, you don’t. Sounds a bit like the Heathrow issue?

In payments, we have the same issues, as referenced in discussion of the financial Jenga we deal with.

As long as things are sent and received every time, we are happy. But what happens when they go wrong? What happens if I’m debanked which, like the gate at my property, means that I’m locked out of the system? What happens if I make a faster payment and it goes to the wrong person, which also happens on occasion?

Banking, payments and finance used to be quite easy when you had a physical product – a passbook, cheques and branches – but the more we digitalilse, the more I find myself wondering if we are making the system more fallible and more difficult.

A good example is debanking and frozen accounts. When a bank decides to freeze you out, you are left in a very bad place. Unable to pay for anything or buy the basics, like food, what do you do? A couple of Facebook Groups tell you:

Equally, I find it interesting that Sweden – a country where cash has been squeezed out for years – is now saying you need cash!

In a recent interview with The Banker, Sweden’s central bank governor Erik Thedéen said the country’s banking industry must move quickly to help protect cash and expand offline payments.

“We now need to think about resilience,” Thedéen said. “If everything break[s] down, we [need to] have cash.”

Our world is an interesting place. In fact, the Swedish example tells me that you can have a war on cash but, in a war, you need cash.

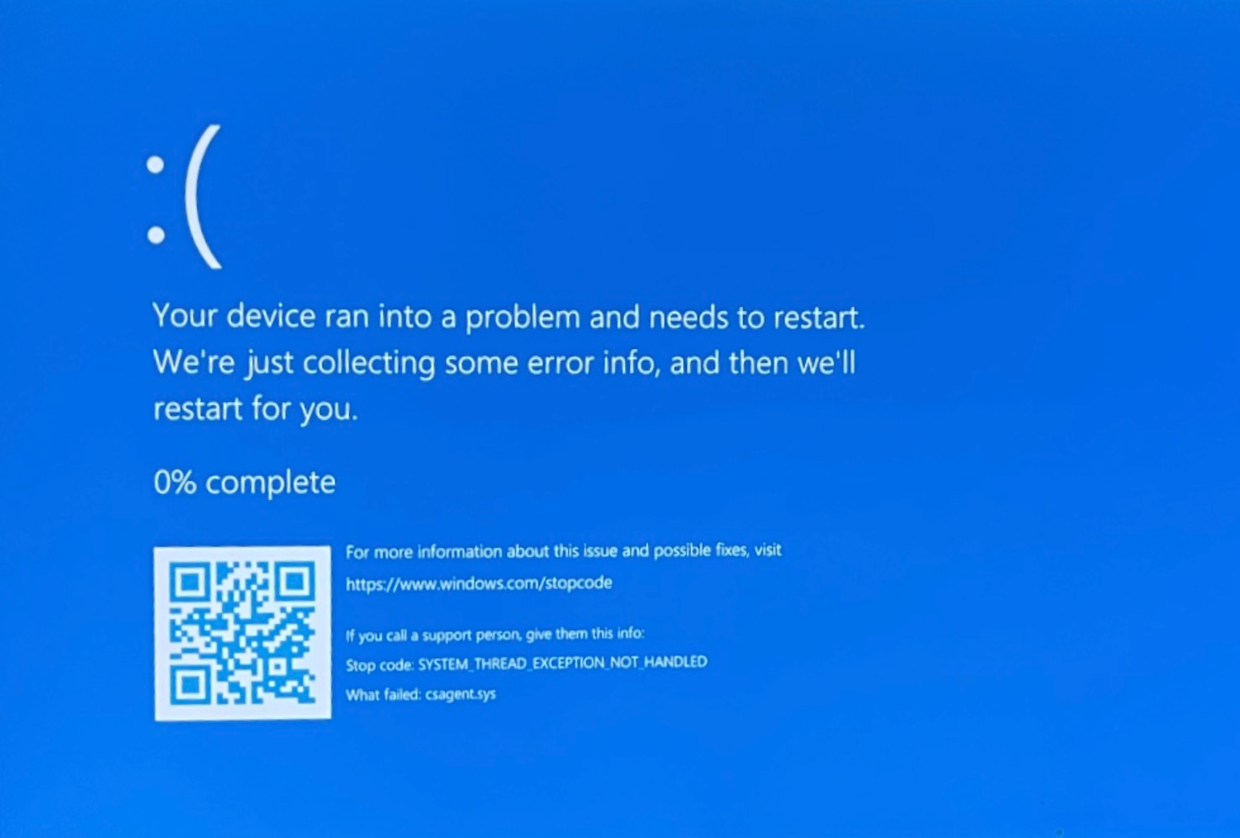

We are now so trusting and reliant on digital systems that we have stopped thinking about the backups. This is true of both individuals and organisations, as demonstrated by my blog about bank IT outages the other day.

So, there are two solutions to being locked out. The first is to have backup systems that work. When SWIFT had a disaster some years ago, they created their third disaster recovery centre to make sure it never happened again. Monzo, because of their concerns of systems failure, has created a complete backup bank.

As an individual, I have two computers, two tablet computers, two mobile telephones, two WiFi networks … and a whole lot of cash in the attic.

It seems ridiculous but you need to have security blankets in the case of emergencies and the only questions is: how many?

The message is that if you rely on a single service, particularly if it is a digital service, you are dumb. Meanwhile, we still need to get the gate open as we’re locked out of the house.