Zacks Small Cap Research – DYLLF: Deep Yellow Makes Significant Progress in Raising Capital; Continued progress toward the commencement of production at Tumas Project in Namibia in 2H 2026. Review of Recent Activities. – Technologist

By Steven Ralston, CFA

READ THE FULL DYLLF RESEARCH REPORT

Deep Yellow Ltd. (OTCQX:DYLLF) (ASX:DYL) is unique among junior mining companies: management has positioned the company to provide a leveraged opportunity to participate in an expected upswing in uranium prices. Management’s Dual Pillar strategy is designed to deliver both organic and inorganic growth by advancing the company’s Namibian and Australian projects through the production stage and when attractive opportunities arise, by acquiring additional projects as the industry consolidates. Management is focused on becoming a low-cost, Tier I uranium producer, defined as a multi-project producer of uranium with the capacity to deliver 5-10 million lbs. of uranium annually.

In addition to advancements at the Tumas Project, along with the Mulga Rock and Alligator River Projects, during the first half of fiscal 2024 (see HALF YEAR INTERIM REPORT section below), the company benefitted from a significant influx of capital during the last three months that totaled almost AUD$250 million in gross proceeds. The net proceeds will be used:

1) to continue to advance the Tumas Project toward production

2) to allow for further development activities at the Mulga Rock Project, including a revised DFS

3) to fund other resource expansion activities through exploration at Alligator River & Omahola

4)to augment working capital

Deep Yellow is poised to enter a crucial stage in the company’s lifecycle, specifically, the transition to the mine construction phase, which will require financings or capital raises. This initial significant equity financing provides the necessary capital to move forward to the Final Investment Decision (FID) for the Tumas Project.

The AUD$250 million in capital was raised through a private placement (AUD$220 million) that was completed in two tranches (one in mid-March and the other in early-May), which in total consisted of the issuance of 179,591,836 shares at an issue price of AUD$1.225 per share. Additionally, 24,489,795 shares were issued to existing shareholders through a Share Purchase Plan, also at an issue price of AUD$1.225 per share. The Share Purchase Plan was oversubscribed by 50%, requiring a pro-rata scale-back of the applications for shares.

Of note, during 2024, several entities were required to file that their ownership of Deep Yellow exceeded 5% of the company’s outstanding shares, most because of participation in the private placement. The entities were Macquarie Group Limited (March 13th), State Street Corporation (March 15th) MM Asset Management of Toronto (April 29th) and Citigroup Global Markets Australia Pty Limited (January 4th and March 25th).

Furthermore, through discussions with financiers, the company is progressing toward securing debt financing that will help fund construction costs of the Tumas uranium mine once the FID is made to proceed, which is expected to be announced near the end of the third calendar quarter of 2024. Typically, debt issued for mine construction is secured by the assets and/or future cash flows of the project.

QUARTERLY ACTIVITIES REPORT

In mid-April, Deep Yellow filed its Quarterly Activities Report for the period ending March 31, 2024.

Tumas Project (100%) Update

Current Tumas Drilling Campaign

On February 29, 2024, an RC and diamond core drilling campaign commenced at Tumas 3 with the objectives to both upgrade and increase the Project’s MRE, while simultaneously bolstering the company’s financing effort to bring the Tumas mine to production. The goal is to define adequate Proven Reserves within the pit locations defined within the Tumas DFS for the mine to operate for initial six (6) years of operation.

The diamond drill spacing in parts of Tumas 3 will be reduced to 50m x 50m, which should support the upgrading roughly 20 Mlbs U308 from the JORC Indicated to Measured category. The 650-hole (13,000m) RC resource drilling program also commenced at the end of February, and as of the end of March, six (6) diamond drill holes (144m) and 189 RC holes (4,221m) had been completed. The entire drilling campaign is anticipated to be completed in June 2024.

As a reminder, in the previous drill program between late March and mid-August 2023, Deep Yellow completed 235 RD drill holes (8,017m) that targeted areas west of Tumas 3 East and Tumas Central. 109 holes explored for additional resources (spaced lines between 200m to 1,000m) and 126 holes focused on expanding the current resource, along line and holes spacing of 100m. Based on the results of the drill program, the Indicated MRE increased 10.4% from 54.9 Mlbs at 320 ppm eU308 to 60.6 Mlbs at 325ppm eU308. The Inferred MRE increased 24.0% from 5.0 Mlbs at 219 ppm eU308 to 6.2 Mlbs at 170ppm eU308. The total Tumas 3 MRE increased 11% to 66.8 Mlbs at 300 ppm eU308. The total ML 237 Indicated Mineral Resource increased to 108.5 Mlbs at 265 ppm eU308.

Metallurgical Testing for the Tumas Project

Metallurgical test work for the Tumas Project continues. Optimization of the beneficiation process has resulted in a material reduction in energy requirements, which is expected to reduce operating costs. Additional test work on the membrane section has significantly improving performance over the assumptions in the DFS, particularly by increasing the permeate yield and achieving a higher selectivity, which results in higher throughput of uranium, vanadium and reagents. These performance improvements should improve the Project’s NPV.

Tumas Definitive Feasibility Study Re-Costing Study

In December 2023, the Tumas Definitive Feasibility Study Re-Costing Study was completed, which updated the base case price of uranium to US$75/lb. from US$65/lb. U308 (a conservative increase considering the spot price has exceeded US$100/lb.) and adjusted the initial cost estimates to reflect the moderating rate of inflation and an abatement of the supply chain pressures. The base case IRR increased from 19.2% to 27.0%.The Re-Costing Study continues to validate the commercial viability of the Project.

Other Near-Term Tumas Activities

During the third fiscal quarter, the process of selecting an Engineering, Procurement, and Construction Management (EPCM) service provider commenced. The EPCM provider is expected to be selected during the fourth fiscal quarter. The detailed engineering phase should commence almost immediately thereafter and require about six (6) months to complete. It is anticipated that the Project will be further optimized when drilling results and subsequent re-estimation of reserves are received. The timeline for the Final Investment Decision is being maintained with the FID expected to be made during the third calendar quarter of 2024.

Mulga Rock Project Update

On February 26, 2024, Deep Yellow released an updated MRE for the Ambassador and Princess deposits at the Mulga Rock Project. The total Measured, Indicated & Inferred U308 Mineral Resources increased 25.6% from 56.7 Mlbs to 71.2 Mlbs with Measured increasing 15.9%, Indicated increasing 57.1%, and Inferred decreasing 30.3%, all at a 100 ppm U308 cut-off. The decrease in the Inferred resource was a result of an overall upgrade of previously lower-grade material into the Indicated category. The updated MRE included drilling results from the 656-hole (36,647m) air core drill program completed in August 2023.

In addition, the updated MRE includes estimates for critical minerals (Cu, Ni, Co, Zn & Rare Earth Oxides) as eU308. Including the critical minerals, the total updated Measured, Indicated & Inferred eU308 Mineral Resources increased 85.7% from 56.7 Mlbs to105.3 Mlbs with Measured increasing 77.8%, Indicated increasing 140.2% and Inferred decreasing 18.6%.

A metallurgical test work program conducted for the Mulga Rock Project (Western Australia) was completed during the third fiscal quarter. The results established the potential commercial viability of recovering critical minerals (base metals and rare earth elements) along with uranium resource.

The metallurgical test work for Mulga Rock indicates that:

• an overall uranium recovery rate above 90% is probable

• overall recoveries for base metals (copper, nickel, cobalt and zinc) and rare earth elements (neodymium, praseodymium, terbium and dysprosium) are above 70% and

The 2018 DFS had uranium recovery rates in the 85.9%-to-89.6% range with no recovery assumed for critical minerals and only around 20% for base metals.

A revised DFS that will optimize the mining method, which will potentially include the recovery of critical minerals, is being undertaken with a completion date anticipated to be in the third calendar quarter of 2025.

Alligator River Project Update

Since the announcement of the 27% increase of the MRE for the Angularli Deposit at Alligator River Project in mid-2023, a heritage survey on EL5893 was conducted in the fourth calendar quarter of 2023, which resulted in conditional approval to explore areas north of Angularli. During the third fiscal quarter, desktop studies continue to delineate prospective corridors, including combining and merging radiometric, magnetic, and gravity data to produce geophysical images that will help identify prospective corridors. A drone-borne high-resolution magnetic and radiometric survey is being planned.

Financial

The company is well funded with a cash balance of AUD$155.6 million as of March 31, 2024. In addition, roughly AUD$100 million was added to the company’s coffers from the oversubscribed Share Purchase Plan in April and from the 2nd tranche of the private placement in May.

ANTICIPATED MILESTONES

Tumas Project

• Final Investment Decision (FID) expected to be made during the latter part of the 3rd calendar quarter of 2024

• If management’s plans continue as expected, production is anticipated to commence during the second half of calendar 2026

Mulga Rock Project

• A revised DFS for the Mulga Rock Project, including base metals and rare earth elements (REE) in addition to uranium, is expected to commence in 2024 with expectations of being completed in the third calendar quarter of 2025.

Alligator River Project

• Desktop prospectivity appraisals to define priority exploration corridors during 2024.

UPDATE ON THE URANIUM INDUSTRY

Since the World Nuclear Association’s Symposium held in early September 2023, the spot price of uranium oxide has increased 48.5%. The stocks of almost all uranium junior mining companies have followed suit. The driving force has been the recognition of the tightening supply/demand structure of uranium market with the projected demand by nuclear power plants increasing and the sequestration of uranium by physical funds (such as the Sprott Physical Uranium Trust and Yellow Cake Plc) continuing. The change in sentiment of utility buyers of long-term contracted uranium has resulted in the volume of contracted volume increasing to the highest level in over a decade. Furthermore, at COP28 (28th Conference of the Parties of the United Nations Framework Convention on Climate Change), which took place in Dubai between November 30 to December 12, 2023, 22 countries pledged to triple the nuclear capacity by 2050.

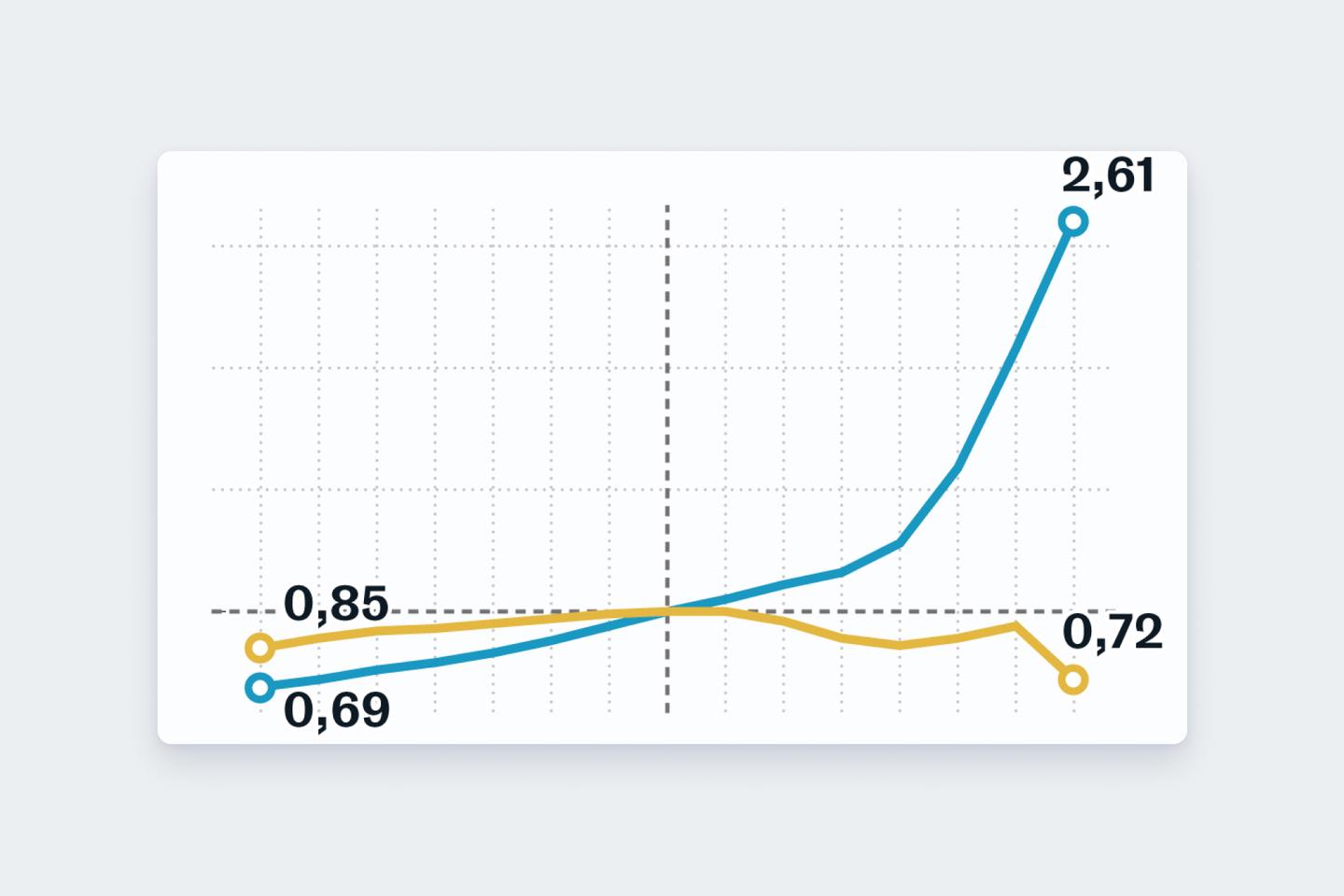

In 2023, the spot uranium price increased 90.9% from US$47.68/lb. to US$91.00/lb. On January 17, 2024, the spot uranium price spiked up to US$106.50/lb., a 17-year high. Meanwhile, Deep Yellow’s stock (OTCQX: DYLLF) rallied over 57.4% from $0.465 to $0.732 in 2023, and a further 53.0% to $1.12 thus far in 2024. The outlook for uranium market continues to be strong with demand exceeding supply for the foreseeable future.

Leading market research firms on the nuclear industry forecast that the deficit between primary supply (from mines) and the demand by nuclear reactors will continue to expand through 2040. In its reference scenario, the World Nuclear Association calculates that the annual primary supply deficit for uranium will exceed 140 million pounds by 2030. Furthermore, in its Base case, UxC estimates that between 2023 and 2040, the needs of operating nuclear reactors will increase by 35%. Both scenarios indicate that new primary production will be needed with the price of uranium being the key determent that will incentivize the development of new mines.

Sentiment noticeably shifted at the World Nuclear Association’s Symposium (held in early September 2023), sparking a stronger tone in the long-term contracting process. Not only are contract prices rising, but also the terms of new collared contracts reflect a tightening market with rising floor and ceiling prices. Long-term contract volume continues to increase from its nadir in 2020.

VALUATION

Broadly speaking, the public uranium companies can be grouped into three segments: producers, development companies and exploration companies. Producers are actively mining and generating revenues. Exploration companies are prospecting and/or drilling to establish mineral resources. In between these two segments are the development companies that already have established resources and are advancing through the process to bring a mine in operation, generally from the point of initiating a Pre-Feasibility Study to the actual construction of a mine. The comparable companies to Deep Yellow fall into this category.

Further, the comparable companies have been narrowed through quantitative factors, particularly those with a market capitalization over $500 million and trading above $1.00 per share. This process captures a range of well-funded junior uranium development companies, which are listed in the table above. Currently, the P/B valuation range of these comparable companies is between 4.64 and 6.53. With the expectation that Deep Yellow’s stock will attain an industry average quartile P/B ratio of 5.9, our comparable analysis valuation price target is US$2.50.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.