Hola compadres!

(We’ve simply obtained again from a weeks trip in Spain, so naturally I’m now fluent in Spanish!…Not).

We’re approaching this blogs sixth birthday, so I believed I’d higher provide you with guys an replace on the venture and the life within the Complete Stability family.

The summer time glided by simply as rapidly as spring got here and went Summer season is my favourite time of the 12 months right here in Denmark, and we’re now slowly getting ready ourselves for an additional lengthy winter (such is the lifetime of us northerners).

When individuals ask me

“So, are you performed with the home venture but?”

I inform them that I really feel we’re 95% there, however in actuality while you stay in an older home, you’re by no means actually going to succeed in 100%…There’s at all times going to be one thing that wants fixing (or the spouse begins new initiatives!). However by way of the renovation of the within of the home, we really feel that we’re 95% there. We’re nonetheless lacking some trim and a few of our closets nonetheless don’t have doorways! (We are able to’t agree on which doorways to get, and likewise we actually don’t wish to spend more cash on closets! haha).

Then there’s the surface of the home. Exterior “renovations” is (when you ask me) a summer time job, so the window of alternative has sort of already handed us by. Naturally, my spouse don’t share that opinion (as you may think about)…

As a result of we nonetheless have some outdoors “renovations” to complete, we’ve obtained some constructing provides saved outdoors, so it’s nonetheless trying considerably like a constructed website. It might be good to get these initiatives completed (however they price money and time!), so we might additionally benefit from the outdoors of the home/backyard.

Anyway, we nonetheless have initiatives to complete earlier than we are able to say that we’re DONE. So we’ve not gotten the home appraised but, so we nonetheless don’t know if the financial institution worth the renovation as a lot as we do. I do know you guys love the numbers, so I’ve performed a fast tally of the key gadgets.

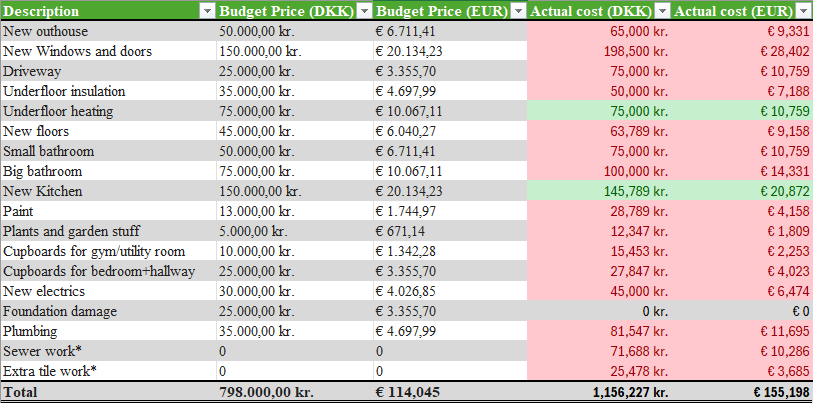

Right here is the finances for the renovation, in comparison with the precise spend (a few of them are estimates):

As you may inform, we managed to blow previous our finances in nearly all main classes…

And sadly, this sheet doesn’t cowl all our precise spending. We’ve spent roughly DKK 100-150.000 greater than this on: I’ve no fucking clue

All of the “small stuff” provides up. I get in a foul temper simply by occupied with this, however I don’t wish to paint the image brighter than it really is. Be VERY cautious when you contemplate enterprise a renovation of this magnitude your self…I can’t actually suggest it, until you’ve gotten very deep pockets!

If we set a conservative worth on our present house – now after the renovation – we’re simply breaking even. If we advertise as we speak at what I consider could be an optimistic value, our efforts would web us a yield of roughly 10%. Since this may be tax free, I suppose it’s not a foul yield for 8 months work, however had you instructed me that this may be the result previous to the reno, I’d positively have mentioned “no thanks”.

However not every thing could be measured in financial worth The transfer to a brand new location has given us and our daughter a complete new stage of freedom and pleasure. Our daughter walks to and from faculty on daily basis, and this has freed up greater than 1 hour of our time on daily basis (commuting to and from faculty). She will be able to additionally now stroll to most of her associates, and this has given her a complete new feeling of independence. It has been all price it after we see how far more pleasure she will get from being nearer to her associates. SHE nonetheless doesn’t acknowledge this reality but – she nonetheless typically say we must always have stayed within the previous home, as a result of then we might have averted all of the stress and onerous work of the reno. I feel in time, she may also be capable of see that it was all price it

The transfer was additionally about decreasing our “operating prices”, and this may also positively profit us going ahead.

Now that the curiosity has begun to say no a bit (for now), subsequent 12 months ought to see respectable financial savings in our month-to-month finances as we at present have a 1-year flex-mortgage. Because of this on January 1st 2025 our mortgage will get a brand new rate of interest.

We at present pay 4.05% (+ charges) and the brand new charge is at present hovering round 3% for the 1-year flex mortgage. Nonetheless, when you repair the speed for five years you may safe a charge round 2.65% (+ charges). The charges range relying in your LTV, but in addition relying on how lengthy you repair it for. For some cause our financial institution favor the 1-year over the 3- and 5-year mounted mortgages. We at present pay 0.57% in payment (bidrag) to the financial institution on-top of the 4% rate of interest. If we convert to 3-year mounted charge we then must pay 0,77% in payment!? This is mindless to me, as this has LESS danger than the 1-year mounted. If we repair it for five years the payment is 0.65%. Because of this proper now, the most cost effective (and most secure choice) could be to repair the speed for five years, which might give us a mixed charge of three.3% (curiosity+payment). From a historic perspective that may be a pretty whole lot…

Nonetheless, our present mortgage is granted based mostly on a 60% LTV. If we get an honest valuation, we might presumably hit <40% LTV. Why does this matter? This is able to put us in a decrease fee-bracket (however it’s going to require us to pay the financial institution to difficulty a brand new mortgage, which additionally has a price).

If we take the common of the conservative valuation (estimated) and the optimistic valuation (estimated) we’re simply 10 month-to-month funds from reaching 40% LTV.

For some cause, the <40% mark is the holy grail. It’s a ladder that goes from 80% to 60% to 40%. Should you’re under 40% LTV the financial institution is contemplating you “low danger”. They thus reward you with a reduction on the payment (bidrag). In our case, if we get a valuation someplace between what we contemplate because the conservative (4.5 million) and the optimistic (5.0 million) we’re inside the 40% LTV vary. However we’re at present on a 30-year mortgage (with 28.5 years left), and getting a brand new mortgage shouldn’t be free. Sadly this ladder doesn’t robotically work in your favor in your present mortgage. That is clearly a “bank-trick” that requires you to PAY for a brand new mortgage so as to drop right into a decrease payment bracket. Typical dipshit bank-move. Anyway, the payment financial savings solely quantities to 0.20% in our case (going from the 60% LTV bracket to the 40% LTV bracket), so it’s extra a matter of principal for me than one thing that truly characterize an incredible financial worth. 0.20% in financial savings over the subsequent 10 years does nonetheless quantity to greater than €4.000 – however getting a brand new mortgage might simply run us €1.500…That leaves €2.500 in potential financial savings.

For now my conclusion on this matter is that it doesn’t make sense for us to PAY to get a brand new mortgage, until the brand new mortgage offers us one thing that our present mortgage doesn’t.

ENTER: The choice of getting a 10-year mounted 3% mortgage (right here the payment would solely be 0.30%). This is able to imply that we might be debt free in 10 years. It might additionally save us a ton in curiosity funds (if we repay our mortgage in 10 years as an alternative of 30). After all it might see our month-to-month mortgage funds double in comparison with as we speak…This is able to imply that we might not have a lot left to place in the direction of our Complete Stability. All the pieces could be used to pay down the mortgage…

What do you guys assume? What would you do?!

Since we’re nonetheless in a “rebuild”-phase each by way of our money reserves and our precise house, I really feel like we’re nonetheless residing inside a venture.

Sadly my psychological state has additionally been considerably deteriorating as of late. It’s been a very long time (years) since I bear in mind feeling “on high”. I feel it’s time for me to conclude and simply put it on the market “on paper” that I’m affected by a gentle despair. I really feel like I’ve misplaced the power to really feel obsessed with something. I don’t have any hobbies, and I’ve turn into a grumpy previous man. A buzz kill. This most likely began method again (earlier than I even began this weblog) and it’s been like being on a curler coaster these previous few years. Few highs, many lows. We might additionally simply name it a mid-life disaster, however on condition that this began in my early 30’s I feel that may be a bit unfair. I’ve been looking for alternative ways to “elevate my spirits” and lift my temper, however I’ve but to search out the silver bullet.

I’m at present sad at work, and that rapidly spills over into my house life, which is actually unfair to my household. I’ve realized that I definitely can’t save myself to happiness, however having 0 cash in my account positively doesn’t elevate my spirit both! I’m hoping that when our spending normalizes and our financial savings as soon as once more start to develop, I would really feel a momentary elevate in spirit – however I do know that it is going to be brief lived. I’ve obtained to discover a extra everlasting repair to my curler coaster. I hoped that somebody smarter than me had the reply, however he too disillusioned. Happiness comes from inside, however spending an excessive amount of time in your personal head appears to have the other impact (at the least that’s my expertise).

Don’t fear, I’m not suicidal or something, however I simply can’t appear to search out contentment in making an attempt to outlive on daily basis. It doesn’t appear to be a lot of a life, when you can’t discover enjoyment in even the little issues. It’s most likely time to go to a(nother) therapist

Yesterday the spouse and I attempted cryotherapy. 3 minutes in a cryo-chamber in your underwear was a reasonably wild expertise! Earlier than that we had spent half-hour in a sauna, so it was an enormous distinction. Warmth shouldn’t be my factor, however the chilly shock I really feel like may maintain some potential. 3 minutes of you simply making an attempt to breathe and block out the acute chilly. Survive for 3 minutes and fear about the remainder later.

The spouse has bought an ice-bath now… Want me luck! HAHA

Till subsequent time!