Three males in the UK have pleaded responsible to working otp[.]company, a as soon as fashionable on-line service that helped attackers intercept the one-time passcodes (OTPs) that many web sites require as a second authentication issue along with passwords.

Launched in November 2019, OTP Company was a service for intercepting one-time passcodes wanted to log in to numerous web sites. Scammers who had already stolen somebody’s checking account credentials may enter the goal’s telephone quantity and title, and the service would provoke an automatic telephone name to the goal that warned them about unauthorized exercise on their account.

The decision would immediate the goal to enter a one-time passcode that was despatched to the consumer through SMS when the thieves tried to log in. Any codes shared by the goal had been then relayed to the scammer’s consumer panel on the OTP Company web site.

An announcement printed Aug. 30 by the U.Okay.’s Nationwide Crime Company (NCA) mentioned three males pleaded responsible to operating OTP Company: Callum Picari, 22, from Hornchurch, Essex; Vijayasidhurshan Vijayanathan, 21, from Aylesbury, Buckinghamshire; and Aza Siddeeque, 19, from Milton Keynes, Buckinghamshire.

KrebsOnSecurity profiled OTP Company in a February 2021 story about arrests tied to a different phishing-related service based mostly within the U.Okay. Somebody claiming to characterize OTP Company then posted a number of feedback on the piece, whereby they claimed the story was libelous and that they had been a professional anti-fraud service. Nonetheless, the service’s Telegram channel clearly confirmed its proprietors had constructed OTP Company with one objective in thoughts: To assist their prospects take over on-line accounts.

Inside hours of that publication, OTP Company shuttered its web site and introduced it was closing up store and purging its consumer database. The NCA mentioned the February 2021 story prompted a panicked message trade between Picari and Vijayanathan:

Picari mentioned: bro we’re in huge hassle… U will get me bagged… Bro delete the chat

Vijayanathan: Are you certain

Picari: A lot proof in there

Vijayanathan: Are you 100% certain

Picari: It’s so incriminating…Have a look and search ‘fraud’…Simply consider all of the proof…that we cba to seek out…within the OTP chat…they may discover

Vijayanathan: Precisely so if we simply shut EVERYTHING down

Picari: They went to our first ever msg…We glance incriminating…if we shut down…I say delete the chat…Our chat is Fraud 100%

Vijayanathan : Everybody with a mind will inform you cease it right here and transfer on

Picari: Simply because we shut it doesn’t imply we didn’t do it…However deleting our chat…Will f*^ok their investigations…There’s nothing fraudulent on the location

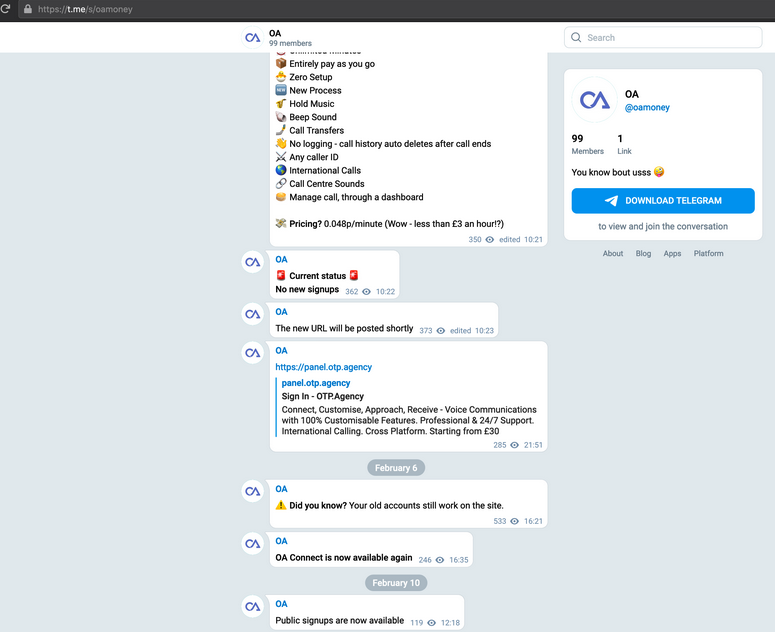

Regardless of deleting its Telegram channel, OTP Company evidently discovered it tough to stroll away from its prospects (and/or the cash). As a substitute of shutting down as Vijayanathan properly suggested, just some days later OTP Company was speaking with prospects on a brand new Telegram channel, providing a brand new login web page and assuring current prospects that their usernames, passwords and balances would stay the identical.

OTP Company, instantly after their preliminary shutdown, telling prospects their current logins will nonetheless work.

However that revival could be short-lived. The NCA mentioned the location was taken offline lower than a month later when the trio had been arrested. NCA investigators mentioned greater than 12,500 folks had been focused by OTP Company customers through the 18 month the service was energetic.

Picari was the proprietor, developer and primary beneficiary of the service, and his private data and possession of OTP Company was revealed in February 2020 in a “dox” posted to the now-defunct English-language cybercrime discussion board Raidforums. The NCA mentioned it started investigating the service in June 2020.

The OTP Company operators who pleaded responsible to operating the service; Aza Siddeeque, Callum Picari, and Vijayasidhurshan Vijayanathan.

OTP Company is likely to be gone, however a number of different related OTP interception companies are nonetheless in operation and accepting new prospects, together with a long-running service KrebsOnSecurity profiled in September 2021 referred to as SMSRanger. Extra on SMSRanger in an upcoming put up.

Textual content messages, emails and telephone calls warning recipients about potential fraud are a number of the commonest rip-off lures. If somebody (or one thing) calls saying they’re out of your financial institution, or asks you to supply any private or monetary data, don’t reply. Simply dangle up, full cease.

If the decision has you anxious concerning the safety and integrity of your account, examine the account standing on-line, or name your monetary establishment — ideally utilizing a telephone quantity that got here from the financial institution’s Site or from the again of your cost card.

Additional studying: When in Doubt, Cling Up, Look Up, and Name Again