Today’s Animal Spirits is brought to you by STF Management:

See here for more information on STFs Tactical Growth and Income fund

Email info@ritholtzwealth.com to work with our Chicago office!

Get a random Animal Spirits chart here

On today’s show, we discuss:

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

The two big losers today:

– People hoping for a Trump-led economic catastrophe

– Members of the Big Chess Party, who thought the tariff announcement was some brilliant, strategic plan that would reshape the global economy in a way that was beneficial for the US.— Joe Weisenthal (@TheStalwart) May 12, 2025

RETAIL INVETSORS BOUGHT $4.7 BLN IN STOCKS ON THURSDAY, LARGEST LEVEL OVER THE PAST DECADE, JPMORGAN SAYS

— *Walter Bloomberg (@DeItaone) April 4, 2025

May 2 pic.twitter.com/j2qlxjHVEV

— Michael Antonelli (@BullandBaird) May 12, 2025

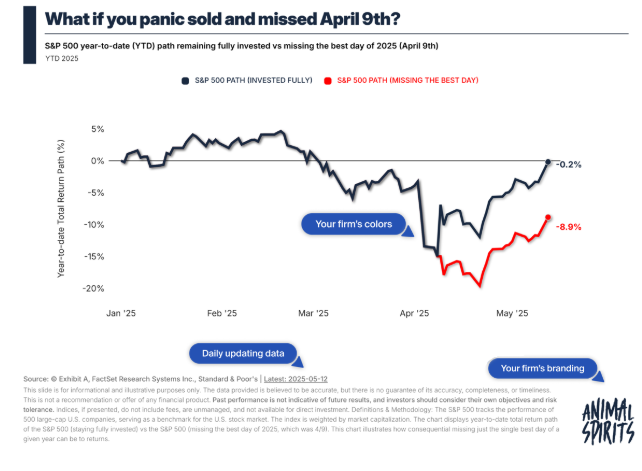

April 9th saw nearly 99% of all the volume on the NYSE higher.

As we noted at the time, that is perfectly consistent with much higher prices coming. We were told it was Quad 4, a recession, a credit event, a bear market rally etc. None of it was true. pic.twitter.com/RUF6bZmrPz

— Ryan Detrick, CMT (@RyanDetrick) May 12, 2025

From Citi, you’ve only needed to own the S&P for 60 minutes in the last month to capture the full 17% recovery.

— Fat Tail Capital (@FatTailCapital) May 12, 2025

“Companies listed on the blue-chip S&P 500 index said last week they expect to repurchase $192bn of their stock over the coming months, the highest weekly figure in data going back to 1995, according to @DeutscheBank .

The tally of announced buybacks over the past three months… pic.twitter.com/zVsUUKq9q0

— Meb Faber (@MebFaber) May 7, 2025

How wage growth in the last quarter century compares to the quarter century before it: discuss.

[“Quarter century” being 24 years] pic.twitter.com/uH78jmWHfe

— Jason Furman (@jasonfurman) May 7, 2025

Who has the best data driven explanation for $ETH’s recent massive move? Narratives are a dime a dozen, I can make them too, show me the data

— Chris Burniske (@cburniske) May 11, 2025

Active listings of homes for sale have skyrocketed in the South relative to the rest of the country according to https://t.co/QV9CUwVso2 data: pic.twitter.com/crlpE61YMT

— Bespoke (@bespokeinvest) May 11, 2025

The Pope’s childhood house in Dolton is currently for sale for $199,900. pic.twitter.com/2FIbhoskyy

— Frank Calabrese (@FrankCalabrese) May 9, 2025

I bought a property in 2017 to Airbnb it.

Purchase price: $315,000

Down payment: ~$63,000

Goal: Passive income, baby!Today, I sold it for $377,750.

BUT let’s compare that to the return if I put that $$$ into the S&P 500.

For the first 6 years, I made about a 4%… pic.twitter.com/DhIl0pEwIN

— Noah Kagan (@noahkagan) May 6, 2025

A legendary addition to our team!

We’re thrilled to welcome Michael Jordan as a special contributor to the NBA on NBC and Peacock. pic.twitter.com/Pjsq8tokfi

— NBA on NBC and Peacock (@NBAonNBC) May 12, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.