I purchased a Peloton train bike throughout the early days of the pandemic.

It’s handy and the know-how is fairly neat.1

However I by no means would have bought shares within the firm. I’ve a rule of thumb that something new that’s fitness-related is a fad. I’ve seen far too many fad diets and fancy train gear or movies come and go over time.

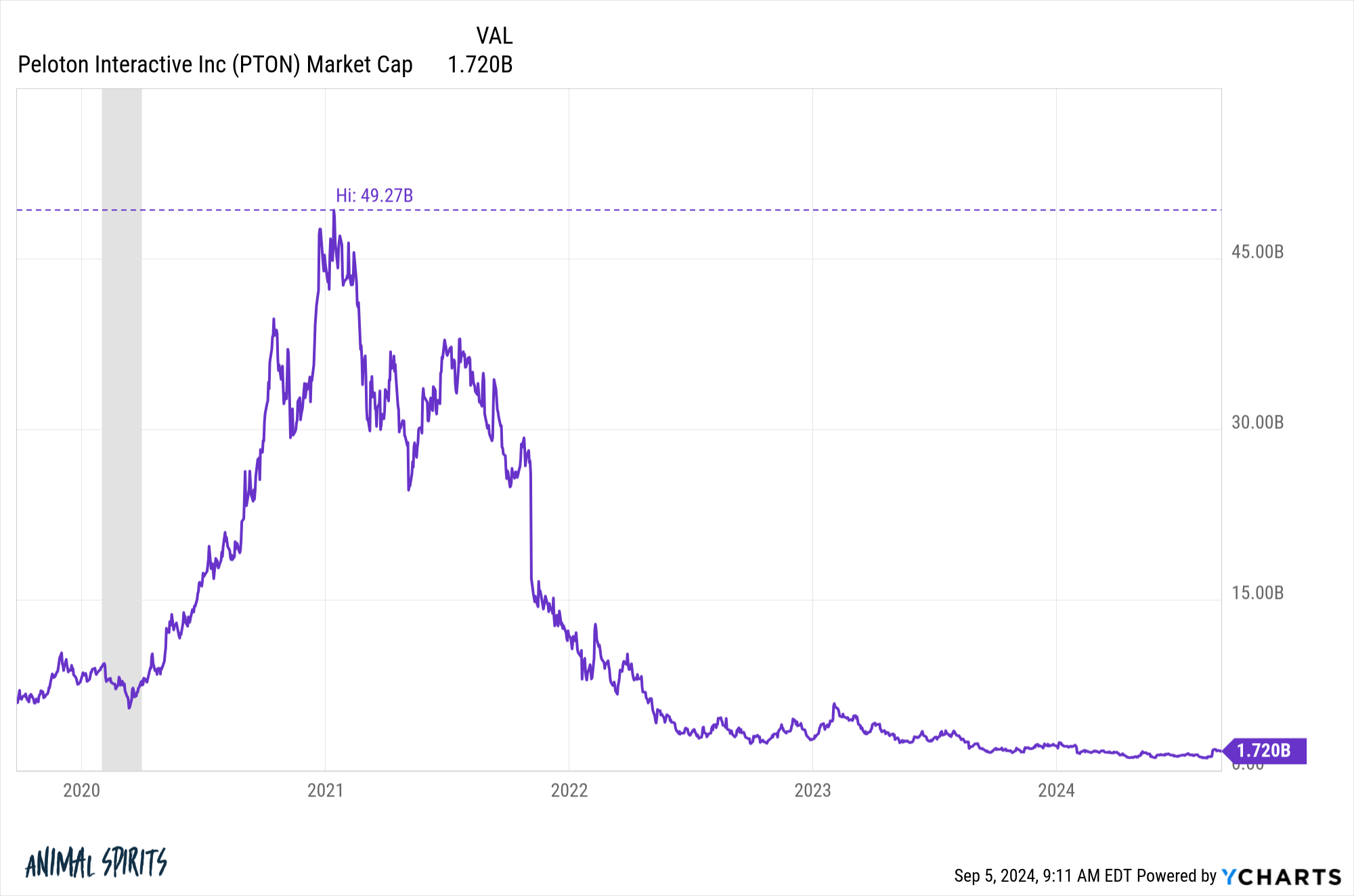

John Foley, the previous CEO of Peloton, didn’t see it this fashion. As he watched the market cap of the corporate skyrocket from $7 billion pre-pandemic to almost $50 billion slightly greater than a yr later, Foley instructed his board Peloton could be a $1 trillion in 15 years.

They responded, “Don’t say that once more. It makes you sound like an fool.”

The board was proper.

Peloton shares crashed as soon as issues bought again to regular and the entire demand was accomplished being pulled ahead.

The inventory is 97% off its all-time highs.

Foley was as soon as value a billion {dollars} (on paper) however misplaced principally the whole lot. The New York Submit just lately wrote a profile about Foley’s rise and fall. Though he’s moved on from the corporate, Foley remains to be optimistic about Peloton’s worth:

However he has little interest in taking an organization public once more. “[Peloton shares] went from $170 to $2 … with that sort of delta, I don’t belief the general public markets to get the pricing proper… [Peloton is] a $40 or $50 firm, from my perspective right this moment,” he stated. (The present value is round $4.50) “The contract of the general public markets getting a valuation proper is damaged.”

Peloton is a sub-$5 inventory. Foley believes it’s a “$40 or $50 firm,” which is a large discrepancy. He blames the general public markets.

To be honest, Peloton did get caught up within the speculative mania of the pandemic days however that is ridiculous. If he actually believes Peloton is that undervalued, he needs to be getting as a lot capital as potential to purchase shares or take the corporate personal.

Foley’s outrageous ideas on market pricing dovetail properly with Eugene Fama’s latest Monetary Instances interview.

Fama created the environment friendly market speculation.

Nobody truly believes markets are completely environment friendly, not even Fama:

Fama is surprisingly phlegmatic with regards to defending his life’s work, echoing the well-known British statistician George Field’s statement that each one fashions are incorrect, however some are helpful. The environment friendly market speculation is simply “a mannequin”, Fama stresses. “It’s bought to be incorrect to some extent.”

“The query is whether or not it’s environment friendly in your function. And for nearly each investor I do know, the reply to that’s sure. They’re not going to have the ability to beat the market so they could as nicely behave as if the costs are proper,” he argues, his hen wrap now effectively devoured. A few of the backlash in opposition to the environment friendly market speculation could merely be right down to hang-ups across the phrase “environment friendly”, which Fama admits he can perceive. “I simply couldn’t consider a greater phrase. It’s principally saying that costs are proper.”

Markets aren’t fully environment friendly however most traders ought to act like they’re. I agree with that sentiment.

This quote from Fama is the one John Foley wants to listen to: “If costs are clearly incorrect then try to be wealthy.”

Inventory costs are hardly ever “proper” however they’re proper extra usually than most traders assume. And in the event that they have been so clearly incorrect on a regular basis it wouldn’t be so onerous to beat the market.

However beating the market is tough!

Simply take a look at the numbers:

Skilled cash managers discover it almost unimaginable to beat the markets over 10, 15 and 20 years.

In that very same interview, there was a quote from AQR’s Cliff Asness about how markets have truly turn out to be much less environment friendly over time:

“I feel [markets] are most likely much less environment friendly than I assumed 25 years in the past,” Clifford Asness, a hedge fund supervisor and a former analysis assistant to Fama, admitted to the FT in an interview final yr. “They usually’ve most likely gotten much less environment friendly over my profession.

This doesn’t appear so as to add up. If markets have gotten much less environment friendly, why are in addition they turning into tougher to beat?

Fortunately, Asness simply revealed a brand new paper for the Journal of Portfolio Administration that lays out his thesis in additional element. It’s an extended piece. I learn the entire thing (to not brag).

Right here’s the principle abstract:

I imagine markets have gotten much less environment friendly over the 34 years because the information in my dissertation ended. I imagine it’s probably occurred for a number of causes however know-how, gamified 24/7 buying and selling in your telephone, and social media particularly are the largest culprits.

I agree with this sentiment. The velocity of market strikes has made issues extra macro-inefficient, even when securities pricing remains to be comparatively micro-efficient. So there may be extra volatility but it surely’s nonetheless very tough to select the winners.

Asness says this may make it extra profitable for traders who can keep on with confirmed methods over the lengthy haul but it surely’s additionally tougher to stay with these methods within the short-term.

Pondering and appearing for the long-term stays your highest chance of success within the markets.

Sadly, it’s tougher than ever to have a long-term mindset.

Michael and I talked about environment friendly markets and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Flash Crashes Are Getting Sooner

Now right here’s what I’ve been studying currently:

Books:

1I actually solely use it now within the winter as a result of that’s once I can’t jog within the chilly Michigan climate.