A reader asks:

Please help settle a disagreement my friend and I are having: He says he’d rather the stock market only go down a little bit and then go up a steady amount every year during his working years because recovering from a 30% drawdown on your current portfolio would be difficult. I would rather buy shares on sale. I’d prefer the market be down 30% for the next 5 years, which will allow me to obtain shares at a discount. Then when I retire have the market rip for the next 10+ years. Can you help mathematically prove which scenario makes the most sense?

I love the fact that these friends are having stock market disagreements. These are my people.

This is a good question for the current environment too.

There have been 46 new all-time highs on the S&P 500 this year. The market keeps going up.

In 2022, there was just a single new all-time high on the first trading day of the year. From there, the market just kept going down.

So what’s the better scenario — investing with drawdowns early in your career or a steady state where things just keep going up?

It really depends on what stage you’re in of your investing lifecycle.

The current market environment is wonderful if you already own a bunch of financial assets. Baby boomers should love these new all-time highs because they’ve been invested for so long and are in or approaching retirement.

You don’t want drawdowns early in your retirement years because you don’t want to be forced to sell stocks while they are down. Sequence of return risk can be a problem if you have bad timing or not enough diversification to see you through an early rough patch in the withdrawal phase.

If you’re a young person who will be making contributions for years to come you don’t want to see new all-time highs on a regular basis. You should hope for more volatility to take advantage of lower prices. You should pray for bear markets to buy stocks on sale.

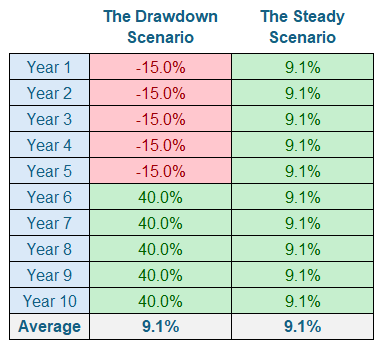

Let’s look at a simple example to put some numbers on it. Here are the two scenarios laid out in the question at hand:

Both the drawdown and steady scenarios end up with the same annual return of 9.1%, but the path to get there is much different.

So which one is better for a saver?

Let’s assume you put $10,000 to work at the start of each year for 10 years in each scenario.

After 5 years the steady scenario is obviously better. Being down 15% for 5 years in a row would lead to a drawdown of more than 55%. But look at where things end up after 10 years of saving and investing:

Both scenarios have the same amount invested ($100k in total) and the same 10 year annualized return (9.1%) but you nearly double your money under the early drawdown scenario.

How is this possible?

You spent 5 years buying stocks at lower prices and then they played catch up over the ensuing 5 years. That’s the dream.

Of course, this is much easier to dream about than implement. Not everyone has the intestinal fortitude to invest when stocks are getting hammered.

Plus, you have no control over the sequence of market returns. It’s more or less random and based on luck and timing than anything else.

The point here is that different risks matter at different times to different investors. There is no one-size-fits-all market environment.

You focus on what you can control, diversify, make good decisions over and over again, increase the amount you save each year and do your best.

But make no mistake — down markets are a win for young investors who will be net savers for years to come. You want markets to fall so you can snap up some screaming deals.

Just don’t run out of the store when everything goes on sale.

We dissected this question on the latest edition of Ask the Compound:

Callie Cox joined me on the show again this week to discuss questions about investing in alternatives, the plight of the homebuyer, the current state of stock market valuations, and overcoming financial mistakes.

Further Reading:

What If You Invested at the Peak Right Before the 2008 Crisis?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.