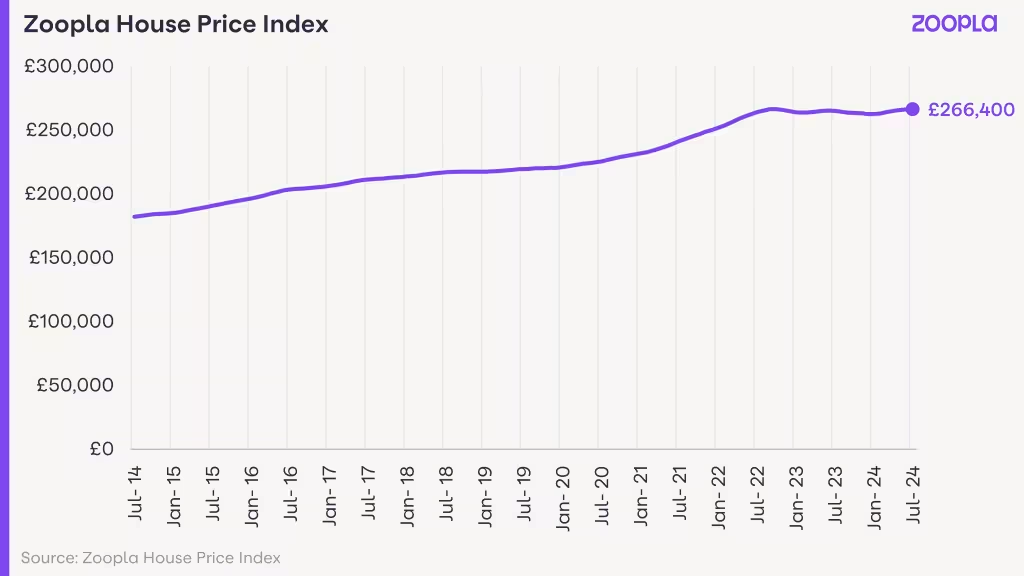

The UK housing market is one of those topics that never entirely goes away. Whether you’re a homeowner, a first-time buyer, or a landlord, everyone seems to have an eye on house prices. In 2024, the story is no different, and thanks to the latest data from Zoopla’s House Price Index, we’ve got some intriguing insights into where the market is headed.

What’s the Current Situation with UK House Prices?

According to Zoopla’s latest data, the average UK property price remains resilient despite ongoing economic uncertainties. While the boom years of skyrocketing growth may be behind us, house prices are still climbing in many areas, albeit at a slower pace. This reflects a delicate balance between supply and demand.

The rise in UK property prices has been influenced by various factors, from economic pressures to regional disparities. We’re seeing a housing market in a state of recalibration rather than stagnation. The days of double-digit price growth may have passed. However, Zoopla’s analysis suggests we’ll still see moderate price growth throughout 2024.

Supply and Demand: The Heart of the Matter

One of the major themes emerging from Zoopla’s data is the impact of supply and demand on UK property prices. It’s Economics 101: prices go up when more buyers than homes are available. But what’s fascinating about the UK in 2024 is that demand hasn’t dropped off despite the rising cost of living and increasing mortgage rates.

So, what’s going on? Part of the reason is that housing supply is still tight, particularly in sought-after regions like London and the South East. People are still willing to pay a premium to live in desirable locations, even if they compromise on property size or features.

Plan Insurance can accommodate your Property Owners & Landlord Insurance needs. Just fill in our short call back form, and our professional brokers will be in contact to arrange your insurance.

Regional House Price Growth: A Tale of Two Markets

When you look at the UK housing market, it’s not a one-size-fits-all story. Regional house price growth has become a defining characteristic of the market. While cities like London remain among the most expensive, they aren’t seeing the same percentage growth as other parts of the UK.

Regions like the North West and Wales have been catching up, experiencing higher price growth than London or the South East. In some of these areas, house prices have risen faster due to a combination of lower starting prices and increased interest from buyers seeking more affordable options. These regional trends are something to watch closely, as they could redefine where the property hotspots are over the next few years.

What Does Zoopla’s Analysis Suggest for 2024?

Zoopla’s data paints a picture of a cooling but still active market. The UK house price index trends in 2024 show that average property price changes vary significantly across the country. Some areas will see continued price growth, while others might experience a slowdown or even minor price drops.

The key takeaway? If you’re in the market to buy or sell, staying informed about regional trends is crucial. It’s not just about what’s happening in the national market—understanding local demand and price shifts can help you make smarter decisions. For instance, homeowners in high-growth areas may still find opportunities to sell at a profit. At the same time, buyers in these regions might need to act quickly before prices increase.

What to Expect Moving Forward

As we move further into 2024, we can expect the UK housing market to remain dynamic, with regional variations continuing to play a significant role. Zoopla’s analysis suggests a market in transition rather than one on the verge of collapse. Prices may not rise as quickly as they have in the past. Still, the demand for homes remains strong, particularly in critical regions.

Understanding the nuances of the market will be essential for those navigating this landscape, whether buyers, sellers, or landlords. While national averages tell one story, the real insight lies in the local trends and how they align with your goals.

Find out why 96% of our customers have rated us 4 stars or higher, by reading our reviews on Feefo.